Protecting your outdoor faucets from freezing temperatures is essential to avoid costly damage. Frozen pipes can burst and lead to leaks inside your walls or foundation. Here’s a simple step-by-step guide to winterize your outside faucets and keep your home safe:

1. Disconnect Garden Hoses

Remove all hoses from outdoor faucets. Leaving hoses attached can trap water in the pipe, increasing the risk of freezing and bursting. Empty the water out of the hoses and store them away for the winter.

2. Turn Off the Water Supply

Find the shut-off valve(s) inside your home that controls the exterior faucets and turn them off. This is normally in the furnace/mechanical room.

3. Drain Remaining Water

Go back outside and open the outdoor faucets to drain any water left in the pipe. Leave the exterior faucets open throughout the winter so any residual water can expand without causing damage.

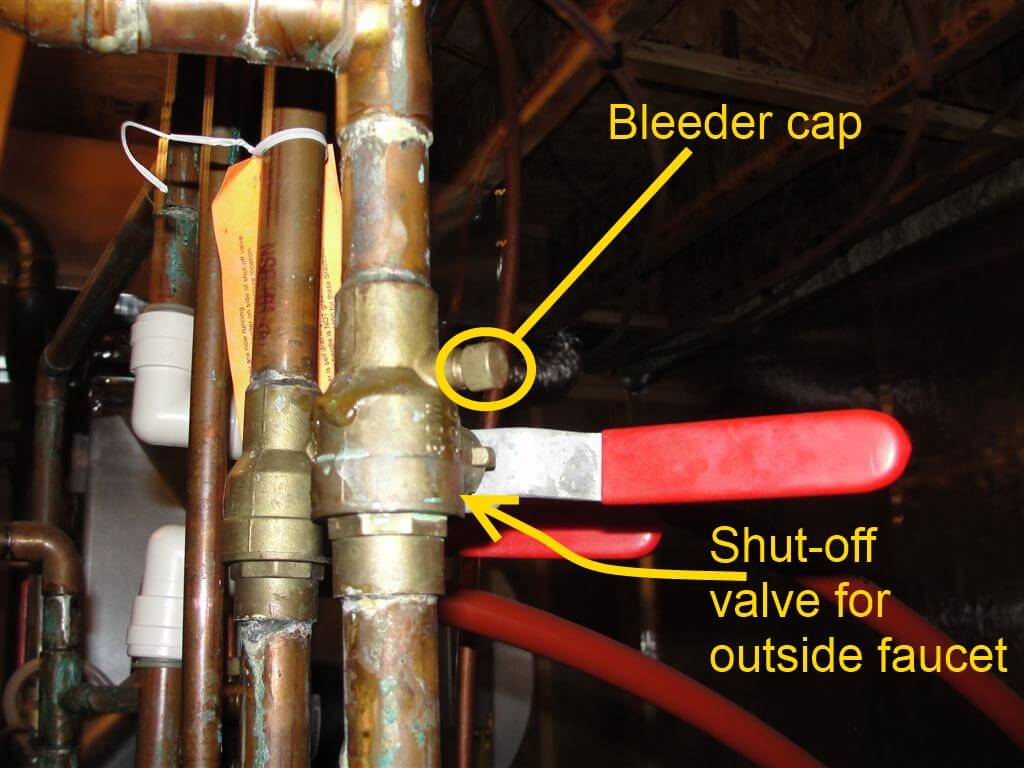

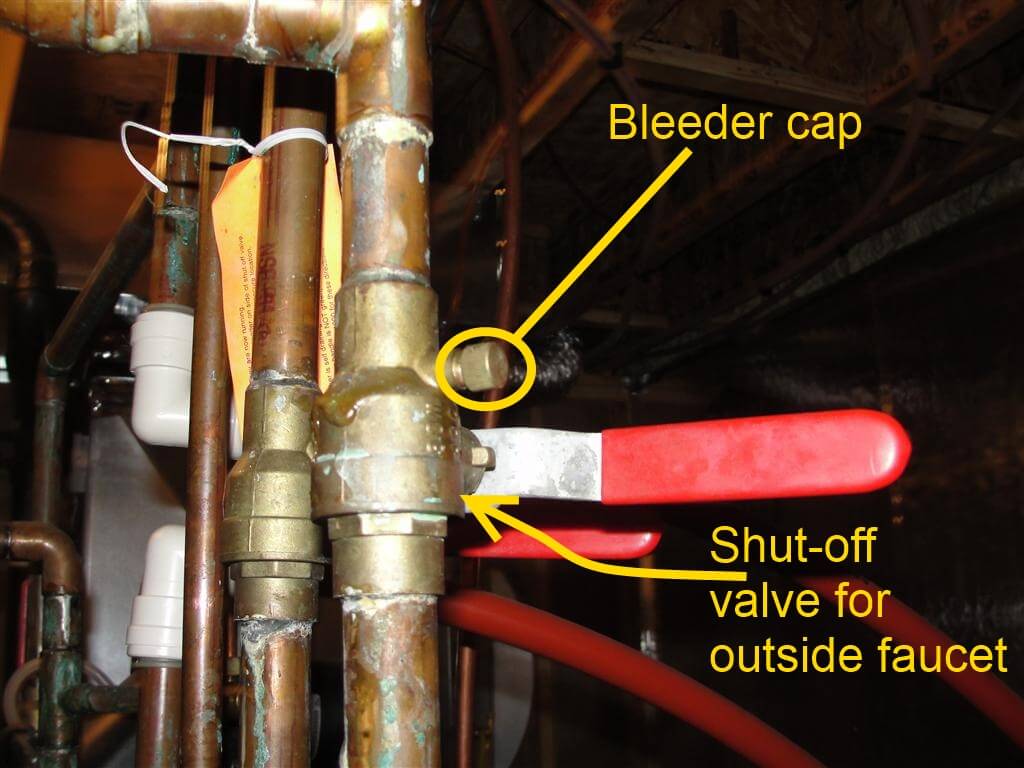

4. Bleed Water Back Out Of The System

Go back to the water shut-off valve(s) and locate the bleeder cap. Open the bleeder cap and have a bucket handy ready to catch the water as you drain the outside faucet water line (to make it a little less messy you can also use a cloth or small towel beneath the bleeder cap and put the end into the bucket, so the water soaks through it into the bucket). Once the water has finished draining simply tighten up the bleeder cap(s). Your system is now winterized.

By taking these simple steps now, you’ll protect your home from water damage and expensive repairs down the road.

Please don't hesitate to reach us to us if you have any questions.